ny paid family leave tax 2021

Enter another line Non-taxable NY Paid Family Leave in the description and the same amount as a NEGATIVE. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836.

Cost And Deductions Paid Family Leave

1887 to inform agencies of the 2021 rate for the New York State Paid Family Leave Program.

. The contribution rate for New Yorks family-leave insurance program is to increase for 2021 the state Paid Family Leave department said Sept. Use the calculator below to. Generally your AWW is the average of your last eight weeks of pay prior to starting Paid Family Leave including bonuses and commissions.

It will increase from 0270 to 0511 of the employees gross wages up to an. 1887 to inform agencies of the 2021 rate for the New York State Paid Family Leave Program. In 2021 these deductions are capped at the annual maximum of 38534.

3 Complete the employer portion of the Paid Family Leave request form when a worker applies for leave. Length of Paid Leave. The maximum annual contribution is 38534.

For 2021 the contribution rate for Paid Family Leave will be 0511 of the employees weekly wage capped at the New York The maximum. Statewide Average Weekly Wage SAWW Maximum Weekly Benefit. The New York Paid Family Leave PFL program took effect in January 2018 and featured annual increases to its benefit entitlements through 2021.

Are benefits paid to an employee under the Paid Family Leave program considered remuneration that must be reported. Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program. This is 9675 more than the maximum weekly benefit for 2021.

Employee-paid premiums should be deducted post-tax not pre-tax. The New York State Department of Financial Services has announced that for calendar year 2021 employers may deduct 0511 of an employees weekly wage up to an annual cap of 38534 to pay the premium cost for PFL. NEW YORK PAID FAMILY LEAVE 2019 vs.

Drop down to Exempt so the employee no longer has the Paid Family Leave deduction taken from future dates paychecks. 1 the contribution rate is to be 0511 up from 027 in 2020 the department. Up to 12 Weeks of Leave.

The weekly contribution rate for Paid Family Leave in 2020 is 0270 of the employees weekly wage capped at New Yorks current average annual wage of per employee per year. This amount is subject to contributions up to the annual wage base. The NYPFL in box 14 is PFL tax that you paid.

Paid Family Leave may also be available. See PaidFamilyLeavenygovCOVID19 for full details. Requirements for other types of employers are.

On December 23 2020 the Office of the State Comptroller issued State Agencies Bulletin No. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. The maximum annual contribution is 42371.

March 7 2021 340 PM. Paid Family Leave may also be available for use in situations when you or your minor dependent child are under an order of quarantine or isolation due to COVID-19. Still dont check the box.

The family-leave insurance contribution rate is to be 0511 in 2021. Benefits for 2021 67 Wage Benefits Receive 67 of your average weekly wage up to a cap. Paid Family Leave provides eligible employees job-protected paid time off.

New York designed Paid Family Leave to be easy for employers to implement with three key tasks. The maximum weekly benefit for 2021 is 97161. The New York Department of Financial Services DFS has announced the maximum employee-contribution rate for 2021.

Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. Here are some contribution and benefit examples at different income levels. In New Jersey go to Other Non-Wage Income.

New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. As the end of summer approaches we turn our attention to the new year and with it changes to New York Paid Family Leave.

If the employee. 2 Collect employee contributions to pay for their coverage. The check box on the uncommon situations screen is for PFL benefits that you received that are included in your W-2.

On September 1 2020 the New York Department of Financial Services DFS published the new premium rate for Paid Family Leave PFL benefits for the calendar year 2021. You will see a Description and Amount from your employers 1099-MISC. In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to cover siblings effective January 1 2023.

A waiver and does not meet the Paid Family Leave eligibility criteria update the FLI Status. The maximum contribution rate will be set at 0511 of the employees. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits.

In 2021 employees who take Paid Family Leave will receive 67 of their average weekly wage AWW capped at 67 of the New York State Average Weekly Wage. FLI- Family Leave Insurance. Use the calculator below to view an estimate of your deduction.

2021 Paid Family Leave Payroll Deduction Calculator. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. In 2021 the contribution is 0511 of an employees gross wages each pay period.

Weekly Benefit of employee weekly wage 60. 0511 of wages Maximum Employee Contribution. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

Family Leave effective January 1 2021. The maximum 2021 annual contribution will. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. The maximum annual contribution is to be 38534. 1 Obtain Paid Family Leave coverage.

For more information or assistance on Paid Family Leave for 2021. Effective January 1 2021 eligible employees are entitled to up to 12 weeks of paid family leave in any 52-week period at 67 of. March 2 2021 1211 PM.

New York Paid Family Leave is insurance that may be funded by employees through payroll deductions. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020.

New York Paid Family Leave Updates For 2022 Paid Family Leave

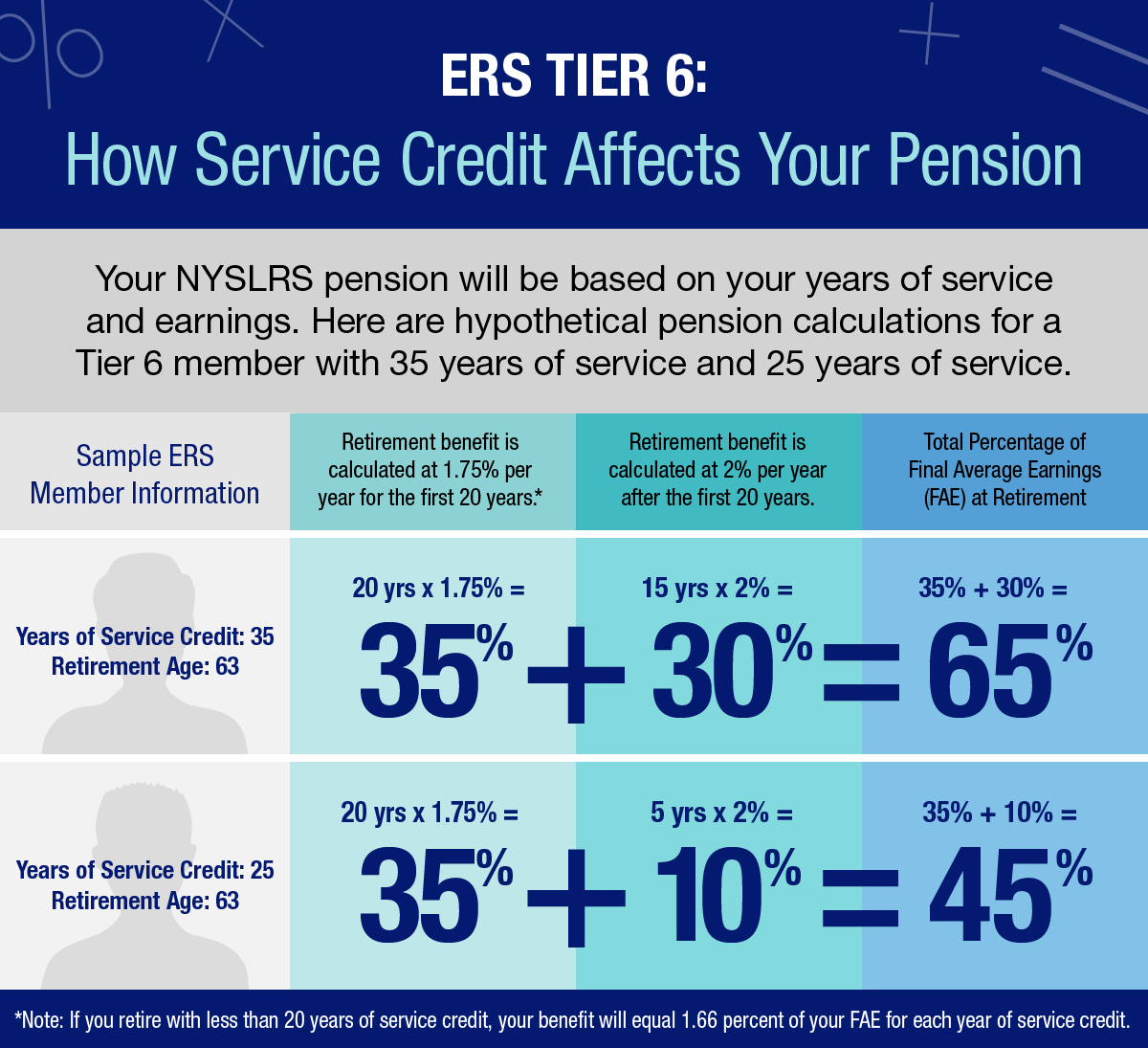

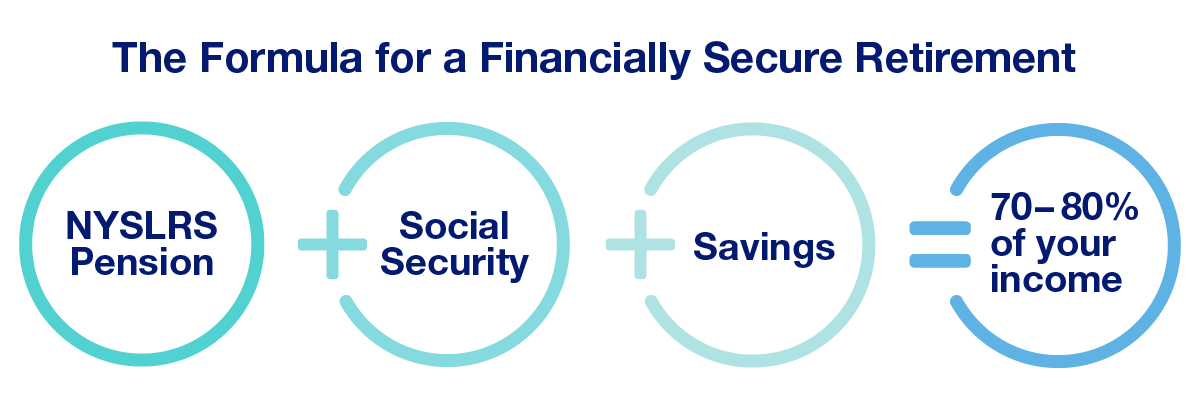

Ers Tier 6 Benefits A Closer Look New York Retirement News

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Paid Family Leave For Family Care Paid Family Leave

![]()

New York Labor Laws 2022 Nys Employment Law Replicon

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Ers Tier 6 Benefits A Closer Look New York Retirement News

New York State Paid Family Leave Law Guardian

![]()

New York Labor Laws 2022 Nys Employment Law Replicon

Out Of State Employers Paid Family Leave

Paid Family Leave For Family Care Paid Family Leave

Copacabana New York 1960 S Copacabana Copacabana New York The Bowery Boys